THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY

Report Highlights:

Namibia consumes about 49,000 tons of beef, 40,000 tons of poultry meat and 6,000 tons of pork per annum. Approximately 50 percent of the Namibian broiler meat and pork market is supplied by the local producers, with the balance supplied by imports, mainly from South Africa. Post estimates that Namibian poultry imports will increase by about 3.5 percent annually, reaching 20,500 tons in 2017 and 21,200 tons in 2018. This expected growth in broiler meat imports will likely be driven by an increase in local demand. Compared to beef and pork, broiler meat is relatively affordable and is increasingly becoming an important protein source in the diet of many Namibians. The United States is currently working with Namibia to obtain full market access for poultry and poultry products.

Meat Consumption

Beef:

More than 60 percent of Namibia’s estimated three million cattle herd is owned by relatively informal, small-scale farmers in communal areas, where the economic potential of cattle farming is underutilized. In 2016, Namibia consumed about 49,000 tons of beef, with more than 80 percent coming from the informal sector. On the other hand, less than 20 percent of formal beef production is consumed within Namibia, with the remaining balance exported mainly to South Africa and Europe (primarily Norway and the United Kingdom). Over the past decade, there has been a gradual decline in the proportion of Namibia’s consumption of locally produced beef from the formal sector. In 2016, about 6,200 tons of beef from the formal beef production was consumed locally, representing a 15 percent decline from 2006. This decline is likely due to a number of factors including the frequent droughts experienced in Namibia, especially in 2013, 2015 and 2016. The droughts led to a reduction in the number of cattle available for slaughter. Additionally, the formal beef production sector has become more export oriented. In 2016, Namibia became eligible to export boneless (not ground) raw beef products to the United States. However, Namibia is yet to export beef to the United States as it is still in the process of finalizing the export protocols. Namibia has managed to gain access to European and U.S. markets mainly by focusing on marketing its beef as naturally raised and free of hormones and antibiotics.

Poultry:

Namibia consumes about 40,000 tons of poultry meat per annum. Poultry meat consumption per capita increased significantly from about 10kg in 2006 to almost 16kg in 2016. This rise in consumption is due to steady increases in per capita income, urbanization, population growth and relative affordability of broiler meat as compared to other sources of protein. Post forecasts that Namibian poultry consumption will grow steadily by an annual average of four percent, reaching about 41,600 tons in 2017 and about 43,300 tons in 2018. The growth in consumption is due to the relative affordability of poultry meat and changing dietary preferences of consumers. The growth in the consumer demand for broiler meat is likely to be supplemented with imports, as Namibia’s primary poultry producer is currently unable to meet local demand. In fact, approximately, 50 percent of the broiler meat market is supplied by the local producers, with the balance supplied by imports mainly from South Africa.

Pork:

Pork consumption per capita increased marginally from about three kilograms in 2006 to about four kilograms in 2016. In 2016, Namibia consumed about 8,000 cwe tons of pork, with imports accounting for about 50 percent of the total consumption. Pork consumption increased only modestly due to Namibians’ preference for other meats as a primary source of protein. However, dietary diversity, relative affordability of pork and urbanization are expected to drive marginal growth of pork consumption in Namibia. As a result, Post forecasts that overall pork consumption will increase incrementally by an annual average of two percent, reaching 8,160 cwe tons in 2017 and 8,300 cwe tons in 2018.

Poultry Meat Imports

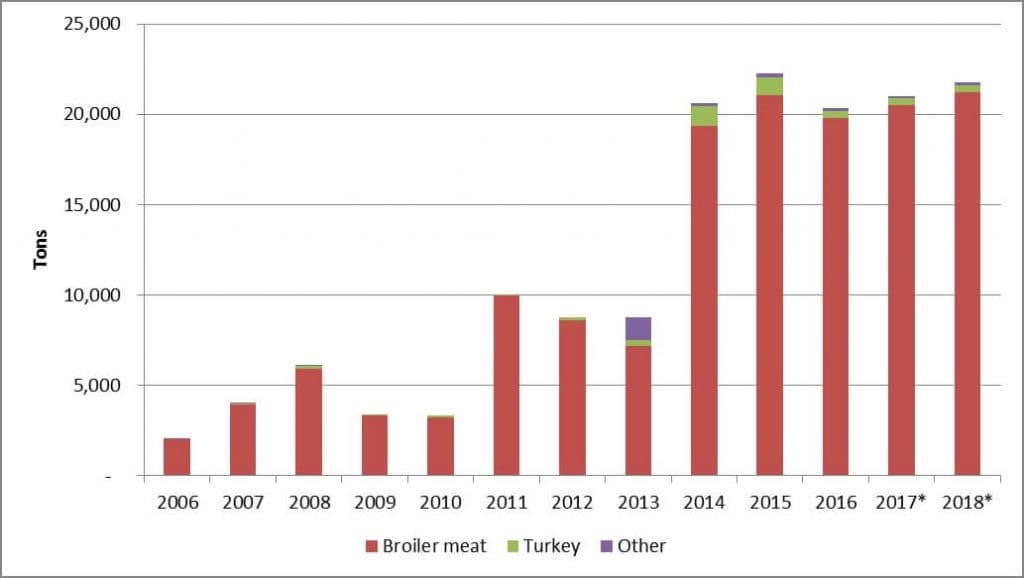

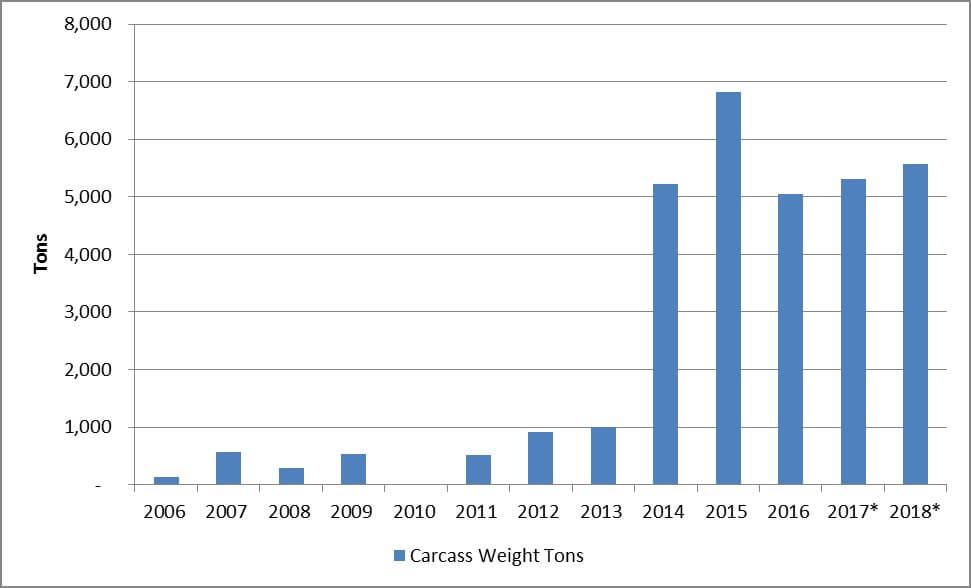

In 2016, Namibia imported about 19,800 tons of broiler meat. Broiler meat imports account for more than 94 percent of the Namibian poultry imports, with turkey meat largely accounting for the remaining balance (Figure 1). Post estimates that Namibian broiler meat imports will increase by about 3.5 percent annually, reaching about 20,500 tons in 2017 and 21,200 tons in 2018. This growth in broiler meat imports will likely be driven by an increase in local demand as broiler meat is relatively affordable and is increasingly becoming an important protein source in the diet of many Namibians.

Source: GTA

*Estimate

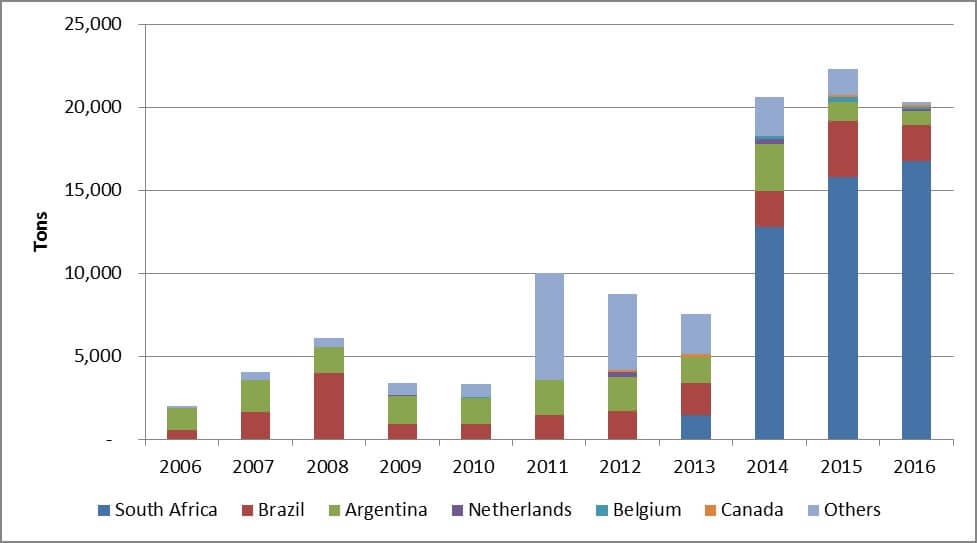

The local poultry producer can only supply about 50 percent of the local demand; therefore the growth in local broiler meat demand will be supplemented by imports. In 2016, South Africa accounted for more than 75 percent of the Namibian poultry meat imports (see Figure 2). The second largest exporter of poultry meat to Namibia in 2016 was Brazil, with a market share of about 11 percent. The United States is currently working with Namibia to obtain full market access for poultry and poultry products.

Source: GTA

Trade Restrictions:

The recent fluctuations in the amount of broiler meat imported by Namibia are due to the trade restrictions imposed by Namibia. The largest broiler meat producer in Namibia became operational in 2012. Prior to that, Namibia imported all its poultry meat. In 2013, Namibia restricted imports of poultry and poultry products in order to protect its infant poultry industry. Thus, importers could only import about 600 tons of poultry and poultry products per month. The restriction was later relaxed to 900 tons per month in 2014. However, since the major Namibian producer cannot satisfy local demand, the import quota was increased to 1,500 tons per month. Currently, the import quota is set after every two months by the government in consultation with the largest local producer and importers.

Beef Imports

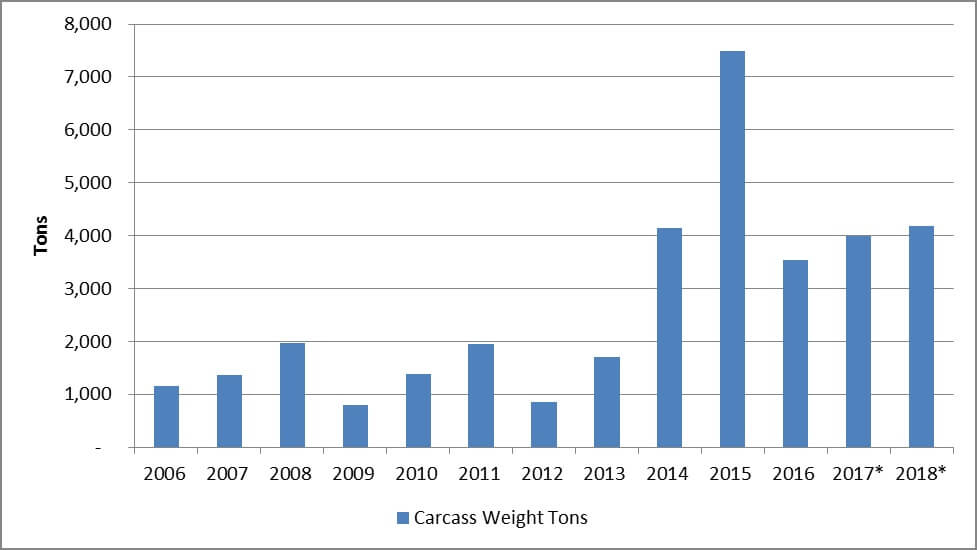

Currently, local beef production is under pressure due to the herd rebuilding phase, following herd liquidation during drought in 2014 and 2015. Therefore, Post forecasts Namibian beef imports will increase by about 13 percent to 4,000 cwe tons in 2017 and by another five percent to 4,200 cwe tons in 2018. Despite Namibian beef imports increasing significantly by more than 200 percent over the past decade, reaching 3,529 cwe tons in 2016 (Figure3), Namibian beef imports account for only about 0.12 percent of the world beef imports in value terms. This could be attributed to Namibia’s small population (about 2.5 million people) and that Namibia is a net exporter of beef. In 2016, South Africa accounted for about 83 percent of the Namibian beef imports, followed by India with a market share of about 14 percent.

Source: GTA

*Estimate

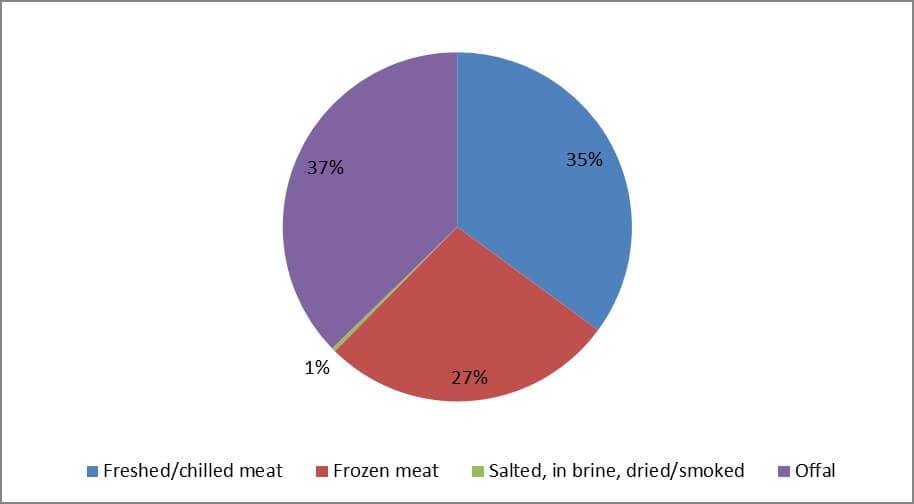

In 2016, offal accounted for about 37 percent of the Namibian beef imports (Figure 4). Fresh or chilled beef and frozen beef accounted for 35 percent and 27 percent, respectively, of the total beef imports by Namibia in 2016.

Source: GTA

Pork Imports

The drought in 2015 and 2016 led to local pork producers facing high animal feed costs, which account for up to 75 percent of the production costs. However, the prices of animal feed are declining due to a good corn harvest obtained in Namibia during the 2016/2017 season. Namibia does not produce enough animal feed for its meat production. Thus, more than 35 percent of the animal feed is being imported from South Africa, where current animal feed prices are low due to the historic high corn harvest in 2016/2017 season. The low animal feed prices are expected to lead to improvement in the potential profitability of pork production suppressing the recent exponential growth of imports. Furthermore, growth of pork imports is hampered by the Pork Market Share Promotion Scheme (PMSPS), which requires importers to first buy locally produced pork before they can be issued import permits. The scheme aims to restrict the quantity of imports of fresh, frozen pork cuts or carcasses; under the PMSPS, importers are required to buy one kilogram of pork produced locally for every three kilogram of pork they import. As a result, Post forecasts pork imports will decrease marginally by an annual average of 2.5 percent, to about 4,900 cwe tons in 2017 and 4,800 cwe tons in 2018 (Figure 5).

In 2016, Namibia imported about 5,100 cwe tons of pork, accounting for about 50 percent of its total pork consumption. South Africa is the largest exporter of pork to Namibia, responsible for about 92 percent of the Namibian pork imports in 2016.

Source: GTA

*Estimate